Invest With Platinia, Inc

10% - 25% Per Deal For 60 Days

🏠 Welcome to Platinia Inc. — Where New Investors & Capital Partners Win Together

Platinia Inc. is built for two types of people:

🔹 New Real Estate Investors

You want to get started in real estate —

but you may not have the knowledge, systems, confidence, or deal experience yet.

With Platinia Inc., you don’t have to do it alone. We do the investments for you. This is a "Done For You" System.

We partner with first-time and developing investors so you can:

learn hands-on from an experienced acquisitions team

leverage our AI deal evaluation & contract workflows

access real deals, real mentoring, and real results

You get to grow while you earn, with a proven deal partner by your side.

🔹 Investment Partners & Capital Investors

If you’re looking for a strategic way to grow your money —

Platinia Inc. provides access to:

* Deeply-vetted wholesale opportunities

* Cash-flow driven seller-finance structures

* Partnerships backed by real assets — not speculation.

Your capital participates in real opportunities

sourced, analyzed, and managed through our acquisitions system.

We focus on risk-controlled, fundamentals-based real estate —

not hype, not guessing, and not gambling.

🤝 Partnership Over Guesswork

Whether you’re:

just getting started in real estate, or

seeking a smart way to scale capital with experienced operators…

Platinia Inc. was built to bridge the gap between:

* Ambition and experience

* Opportunity and execution

* Investors and trustworthy deal partners

See our AI Deal Engine in Action

"Experience the live platform in action. This isn't a pitch - it's a Live Working System. Visit https://platiniainccashoffers.com where real Sellers submit their properties for sale and where Megan AI qualifies the Seller, analyzes the deal, gives the seller an offer and then get the property under contract, while still on the phone with Seller."

There is nothing like this.

MEET THE FOUNDER/CEO & CFO's

David & Ray

Our Leadership Story

Two Different Journeys — One Shared Mission

Platinia Inc was not created in a boardroom or born out of theory — it was built from real-world experience, perseverance, and a commitment to creating smarter real estate opportunities.

The company is led by two individuals whose paths took very different routes, but converged with one common purpose to build an investment-ready wholesale acquisitions company grounded in integrity, discipline, and long-term results.

* David Bishop — Founder & Chief Executive Officer

David’s path into real estate wasn’t glamorous — it was built through grit, trial-and-error, and relentless determination.

He began as an independent investor and acquisitions specialist, knocking on doors, calling sellers, negotiating contracts, and learning every lesson the hard way.

Over time, David recognized the biggest flaw in the wholesale industry, too many deals were emotional, unstructured, and financially inconsistent.

Instead of accepting the status quo, he set out to fix it.

David began developing a disciplined, system-driven approach to acquisitions — one that removed guesswork, enforced underwriting logic, and created predictable assignment outcomes for investors.

Platinia, Inc was born from that journey.

Today, he leads the company with the perspective of someone who has been in the trenches, understands how deals break — and knows what it takes to make them work.

His leadership philosophy is simple:

✔ Structure before speculation

✔ Discipline before volume

✔ Sustainability over hype

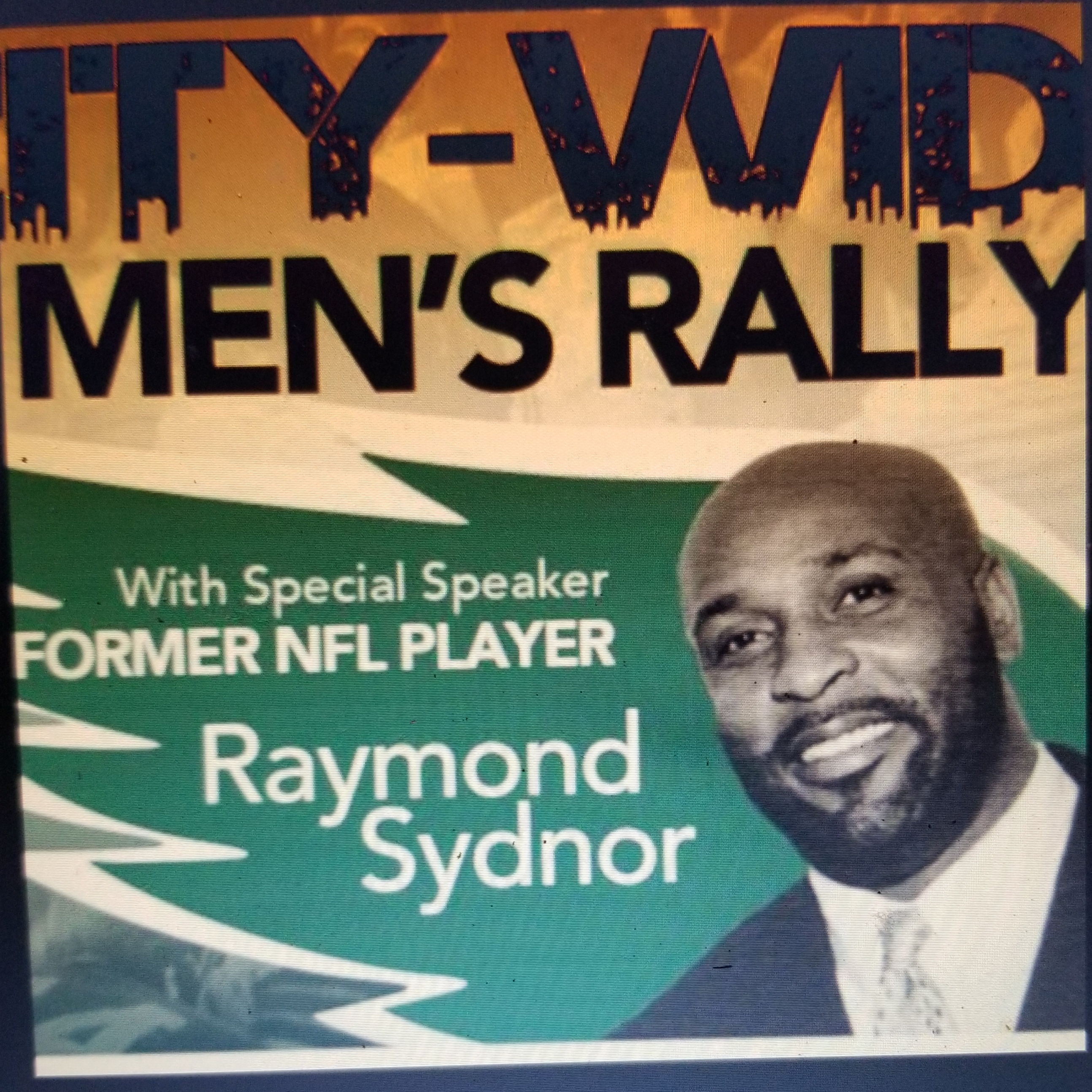

* Raymond “Ray” Sydnor — Chief Operating & Financial Steward

Ray’s story comes from another world of pressure and performance — professional athletics.

As a former NFL athlete with the Philadelphia Eagles, Ray learned early that success demands consistency, accountability, and mental discipline. After professional football, he transitioned into leadership, mentoring, and community development roles — helping build programs, guide young professionals, and strengthen organizations from the inside out.

When Ray joined Platinia Inc, he brought something invaluable:

calm leadership, financial steadiness, and operational maturity.

He ensures:

Capital is deployed responsibly

Acquisitions strategy remains grounded

Partnerships align with long-term growth

investor trust is always preserved.

Ray doesn’t just manage numbers — he reinforces culture.

He helps guide Platinia Inc with the same traits that fueled his athletic career:

✔ Preparation

✔ Resilience

✔ Accountability

✔ Team-first execution

Why Their Partnership Works

* David brings:

Acquisitions strategy

Technology-driven systems

Deal structure innovation

* Ray brings:

Financial discipline

Leadership stability

Long-term operational vision

Together, they share a unified belief:

"Wholesale real estate should be built on principles, not shortcuts — and investors deserve partners who treat every deal as if their own name is on it."

“Why Investor's Choose Platinia Inc”

ABOUT PLATINIA INC

Where Real Estate Discipline Meets Technology-Driven Deal Execution

Platinia Inc is a performance-driven real estate acquisitions and wholesale contracting firm built for scale, precision, and results. We specialize in sourcing, negotiating, and assigning investment-grade residential property contracts to qualified buyers nationwide — with a business model built on discipline, data, and operational efficiency.

While most wholesalers chase deals, Platinia Inc engineers consistency. Our acquisitions process is powered by AI-guided seller engagement workflows verified valuation and underwriting logic streamlined contract execution systems structured buyer assignment pipelines.

This allows us to operate with speed — without sacrificing financial responsibility or deal viability. We don’t guess. We don’t speculate. We execute only on opportunities that make sense. A Smarter Approach to Wholesale Acquisitions

The traditional wholesaling model is unpredictable. Leads are inconsistent. Negotiations lack structure. Many contracts never assign.

Platinia Inc was built to solve that problem. Our platform integrates automated seller intake, disciplined price modeling,

contract-ready qualification standards and investor-focused assignment strategy.

From first seller conversation to signed agreement — our process is engineered to:

Reduce failed contracts

Protect investor profitability

Streamline deal turnover timelines

Every decision runs through underwriting discipline and exit-strategy awareness.

Technology-Enabled. Human-Led. Results-Focused.

Artificial intelligence enhances our workflow — it does not replace accountability.

Our AI-enabled acquisitions framework:

Evaluates property data efficiently

Maintains structured seller dialogue

Eliminates pricing guesswork

Accelerates decision readiness

Our team provides human oversight, financial judgment and boots-on-the-ground realism.

This balance allows Platinia Inc to scale — while remaining grounded in real-world investment logic. Built for Investors Who Value Performance Over Promises.

Platinia Inc does not sell hype, projections, or “pipe-dream” valuation spreads.

We focus on:

Assignable deals that truly make sense

Ethical seller communication

Fair-but-firm negotiation standards

Alignment with end-buyer cash-flow needs

Our operating philosophy is simple, Protect the deal. Protect the numbers. Protect the relationship.

When our investors win — we win.

The Investment

How the Investment Opportunity Works

Partner With Platinia Inc

The Platinia Inc Investor Partnership provides a unique opportunity to participate in the revenue generated from our wholesale real estate acquisition and contract-assignment operations — without requiring investors to purchase, rehab, or personally manage property.

Our business model focuses on:

Identifying motivated sellers

Contracting properties at favorable terms

Assigning those contracts to cash buyers

Collecting assignment fees at closing

Investor capital is used strategically to increase lead volume and acquisitions capacity, primarily through scaling paid marketing and seller-intake infrastructure.

This allows Platinia Inc to:

Expand deal flow

Shorten acquisition timelines

Increase the number of assignable contracts

Pursue higher-volume pipeline activity

What the Investor Receives:

In exchange for providing working capital support toward marketing expansion and acquisitions operations, the Investor receives:

✔ 10% - 25% of Platinia Inc Net Wholesale Profits

This applies to:

All qualifying wholesale assignment fees

Generated during the 60-day participation period

Beginning with the first successfully assigned deal

Profit share is performance-based — meaning returns are earned only when deals are successfully contracted, assigned, and closed.

There is no speculative return structure, and no accrual interest model.

The Investor partner earns directly from real assignment transactions.

How Investor Capital Is Deployed

Funds are allocated primarily toward:

Scaling Facebook ad campaigns

Expanding motivated seller targeting

Increasing inbound lead volume

Supporting acquisitions call flow & follow-up

Accelerating contract-ready opportunities

This approach focuses capital on:

👉 deal generation rather than asset speculation

allowing activity to be:

Measurable

Repeatable

Performance-driven

Why This Opportunity Is Attractive

This partnership benefits the Investor by providing:

✔ Participation in proven wholesale opportunities

✔ Aligned compensation based on real revenue events

✔ Zero exposure to rehab, holding, or construction risk

✔ Access to an experienced acquisitions team & system

At the same time, Platinia Inc benefits from:

Predictable marketing scale

Accelerated deal volume

Larger buyer-assignment pipeline

The result is a mutually aligned, performance-based structure where both parties succeed when contracts close and profits are realized.

Defined Participation Window

The Investor’s 10% -25% profit participation applies for:

60 days from the start of partnership and includes:

Every wholesale assignment Platinia Inc closes during that time period regardless of deal count or assignment fee size.

At the end of the 60-day period partnership may conclude, or both parties may mutually renew or expand scope

Renewal discussions are based on:

Performance results

Capital efficiency

Volume growth achieved

The Payout

"How Your 10% - 25% Profit Share is Tracked, Distributed and Paid out Over 60 Days"

Marketing Spend & Revenue Growth Model

Platinia Inc. currently operates a conservative advertising model of $10 per day in Facebook motivated-seller marketing,

which generates a predictable pipeline of off-market wholesale leads.

Our system is engineered so that increased ad spend directly increases:

Seller lead volume

Contract acquisition opportunities

Assignment fee revenue

✅ Marketing Spend & Deal Growth Model (Clean + Investor Friendly Version)

Platinia Inc uses a predictable marketing and AI-driven acquisitions system that converts motivated-seller leads into wholesale real estate assignments.

Our process is simple:

1️⃣ Sellers respond to our ads

2️⃣ Our AI system qualifies and evaluates the property

3️⃣ We place the property under contract

4️⃣ We assign the contract to a cash buyer

5️⃣ Platinia Inc receives an assignment fee

Typical assignment fee range:

➡️ $7,500 – $15,000 per deal

(Conservative baseline modeling assumes $10,000 average)

Investor profit share is only paid on closed and funded deals.

📊 Current Performance — $10/Day Operating Model

Monthly Ad Spend: $300

This produces a steady and predictable inbound seller pipeline.

Expected conservative output:

Leads per month: 12–20

Contracts per month: 1

Avg Assignment Fee: $10,000

Financial outcome:

$10,000 Gross Assignment Fee

– $300 Marketing Cost

= $9,700 Net Before Investor Share

✔ This is our proven operating baseline

✔ All numbers below scale from this foundation

🚀 Investor Expansion Scenario — $30/Day Marketing Budget

Monthly Ad Spend: $900

Expected conservative output:

Leads per month: 30–50

Contracts per month: 2

Avg Assignment Fee: $10,000

Financial outcome:

$20,000 Gross Assignment Revenue

– $900 Marketing Cost

= $19,100 Net Before Investor Share

👉 This level is ideal for consistent deal flow

💰 Growth Scale Scenario — $50/Day Marketing Budget

Monthly Ad Spend: $1,500

Expected conservative output:

Leads per month: 60–80

Contracts per month: 3

Avg Assignment Fee: $10,000

Financial outcome:

$30,000 Gross Assignment Revenue

– $1,500 Marketing Cost

= $28,500 Net Before Investor Share

👉 This level is designed for high-volume acquisitions

🟢 Important Notes for Investors

We use conservative projections, not hype.

This model assumes:

✔ Only a portion of leads convert

✔ Assignment fee estimates remain mid-range

✔ Market averages remain reasonable

✔ Scale produces volume — not risk

No projections include:

✘ Flips

✘ Rentals

✘ Appreciation

✘ Speculative Upside

This is strictly:

Net Before Investor Share

Marketing Scale

10% Share

20% Share

25% Share

Tiered Investor Participation Payouts

* We keep payouts straightforward and transparent.

* $2,500 Investor

* Participation term: 60 days

* Rollover protection included

* 10% of assignment fee per qualifying deal

________________

* $5,000 Investor

* Participation term: 60 days

* Rollover protection included

* 20% of assignment fee per qualifying deal

_________________

* $10,000 Investor

* Participation term: 60 days

* Rollover protection included

* Premium partner tier

* 25% of assignment fee per qualifying deal

__________________

➡️ Example Payouts:

$10/day Ad Spend ($300 Monthly Spend) = 1 Deal

Wholesale → Assignment

$10,000 $9,700

Revenue Share:

10% = $970

20% = $1,940 $

25% = $2,425

$30/day Ad Spend ($900 Monthly Spend) = 2 Deals

Wholesale → Assignment

$20,000 $19,100

Revenue Share:

10% = $1,910

20% = $3,820

25% = $4,775

$50/day Ad Spend ($1,500 Monthly Spend) = 3 Deals

Wholesale → Assignment

$30,000 $28,500

Revenue Share:

10% = $2,850

20% = $5,700

25% = $7,125

Because our AI systems automate:

* Lead Intake

* Underwriting

* Follow-Up

* Contracts

* Dispositions

Operations scale without additional headcount risk.

Investor Compensation Structure

We are offering investors:

💰 Up To 25% Profit Share on All Wholesale Assignment Profits

Investor earns:

10% to 25% of net assignment fee revenue

Paid per-deal at closing

No operational labor required

No risk exposure to property ownership

No rehab, holding, or maintenance risk

This model produces:

✔ Recurring monthly passive income

✔ High margin deal participation

✔ Fast liquidity per closing

✔ Lower downside exposure than flips or rentals

Investor capital is used strictly for:

Advertising & acquisition scaling

Lead pipeline expansion

Market testing & buyer demand growth

Exit Strategy — How Our Deals Are Assigned

Once Platinia Inc. secures a signed purchase contract:

1️⃣ Property is evaluated by our AI underwriting & human review

2️⃣ Contract is marketed to our investor buyer network

3️⃣ Buyers include:

* Cash landlords

* Out-of-state investors

* Hedge funds & portfolio buyers

* Airbnb operators

* Rehab & fix-and-flip investors

4️⃣ Buyer signs assignment agreement

5️⃣ Buyer wires assignment fee & closing funds

6️⃣ Title company completes transaction

7️⃣ Investor partner receives their 10% - 25% profit share

Why Our Contracts Are Attractive to Buyers

Our deal pipeline is specifically designed to target:

Undervalued properties

Discounted rental opportunities

Strong cap-rate acquisitions

Properties with instant equity upside

Buyers benefit because:

✔ They avoid agent bidding wars

✔ They acquire property below market value

✔ They receive properties with spread & cashflow potential

✔ They gain access to early-stage off-market deals

Most importantly —

Our underwriting model ensures buyers receive:

*Realistic ARVs

*Accurate repair ranges

*Cashflow-positive purchase point

*Strong rental yield potential

Meaning our deals are profitable from day one instead of speculative flip gambles.

Investor Value Proposition

By partnering with Platinia Inc., investors gain:

*Passive revenue participation

*Asset-light investment exposure

*Recurring deal pipeline returns

*Growth-scalable marketing leverage

Participation in a tech-driven acquisitions platform

Platinia Inc. delivers a repeatable & scalable wholesale system, not one-off speculative deals.

⚖️ Investor Terms — Simple & Transparent:

1. Participation Period — 60 Days

2. Investor participation applies to:

✔ wholesale deals placed under contract

✔ and assigned to a cash buyer

✔ during the 60-day participation window

3. The 60-day period begins on:

👉 The date of the first contracted wholesale deal after funding not the funding date itself

(This ensures investors are not penalized for pipeline ramp-up time.)

4. Rollover Protection (Investor Safety Feature)

If no wholesale deal closes during the initial 60-day period:

a). The participation term automatically rolls over an additional 60 days at no additional cost to the investor until the investor participates in at least one paid assignment deal

This ensures:

✔ the investor is not limited by timing delays

✔ participation applies to real revenue

✔ the investor’s capital is respected and protected

🟢 How Investor Payouts Work

Investor earnings are calculated only from:

✔ assignment fee amounts actually received

✔ from wholesale deals closed and funded

✔ during the active participation period

Payments are issued:

➡️ within 5 business days of Platinia receiving funds

Investors receive:

📄 Closing Statement

📄 Assignment Agreement

📄 Payout Confirmation Report

So every dollar is documented and verifiable.

⚠️ Conservative Projection Disclaimer (Investor-Friendly)

All projections shown:

✔ are conservative, operations-based estimates

✔ reflect historical performance patterns

✔ are not guarantees of future results

Real estate markets can vary based on:

– Lead Quality

– Local Demand

– Buyer Liquidity

– Market Conditions

Platinia Inc does not use speculative or unrealistic growth assumptions.

This model focuses on:

➡️ Predictable Assignments

➡️ Controlled Marketing Scale

➡️ Disciplined Underwriting

How It Works

"A Proven Acquisition Process That Identifies Undervalued Properties and Converts Them Into Profitable Assignments

Step 1 — Motivated Seller Leads Enter the System

We generate motivated seller inquiries using

targeted Facebook ads

local property-owner targeting criteria

forms and inbound call workflows

When a seller responds, they enter our automated intake system.

Our AI-assisted intake process:

Asks qualification questions

Verifies ownership & property details

Gathers condition and situational context

Routes viable opportunities for review

Only qualified leads move forward to underwriting.

Step 2 — Internal Underwriting & Deal Review

Once a property is qualified, our team reviews:

Seller’s asking expectation

Condition & repair considerations

Market comps & rental demand indicators

Buyer-side viability

We only pursue contracts with:

✔ Realistic equity or value spread

✔ Strong investor end-buyer demand

✔ Clear contract assignability conditions

Deals that do not meet criteria are not pursued.

Step 3 — Property Placed Under Contract (When Viable)

If the numbers align and the opportunity qualifies Platinia Inc negotiates a purchase agreement contract includes inspection contingency. Closing is coordinated through title or attorney.

No property is purchased by Platinia Inc.

Our business model is:

👉 Contract acquisition & assignment not flipping or rehabbing.

Step 4 — Contract Assigned to a Cash Buyer

Once the contract is secured, we:

Notify buyers in our investor network

Present the property & contract terms

Collect assignment interest

Coordinate assignment & closing

The end buyer brings cash or transactional funds takes title at closing and pays an assignment fee to Platinia Inc.

This fee is the primary source of profit.

Step 5 — Profits Distributed Per Partnership Agreement

Upon successful closing The title company disburses assignment fee.

Platinia Inc receives assignment proceeds

Investor partner receives 10% - 25% of net wholesale profits (during the 60-day partnership period)

Revenue share begins with:

👉 The first successfully assigned and closed deal

No returns are projected or guaranteed — payouts are performance-based.

Why This Model Works

This approach allows Platinia Inc to:

Scale deal flow without heavy overhead

Avoid property rehab and holding risk

Operate a lean assignment-based business

Focus funding on lead generation rather than capital debt.

The investor partner benefits by:

✔ Participating in active wholesale deal flow

✔ Aligning compensation with real performance

✔ Supporting a replicable acquisition system